Tax saving investment options are crucial for any investor looking to optimize returns while legally reducing their tax burden. Navigating the realm of investments can be complex, especially when it comes to minimizing tax liabilities.

This article explores various tax-efficient investment vehicles and strategies that can enhance your financial portfolio.

Essential Tax Saving Investment Vehicles

Tax-Free Savings Account (TFSA)

Overview

Introduced to encourage savings, the TFSA allows Canadians to earn tax-free investment income. Contributions are not tax-deductible, but all earnings and withdrawals are tax-free.

Benefits (Tax saving investment options)

- Flexibility in withdrawals without tax penalties.

- Suitable for both short-term and long-term investment goals.

Registered Retirement Savings Plan (RRSP)

Overview

The RRSP is a cornerstone of retirement planning in Canada, allowing contributions to be tax-deductible, reducing taxable income in the contribution year.

Benefits

- Tax-deferred growth, meaning you pay taxes only upon withdrawal, typically during retirement when your income may be lower.

- Potential for splitting retirement income with a spouse to further reduce tax liabilities.

Health Savings Account (HSA)

Overview (Tax saving investment options)

In the U.S., an HSA is a tax-advantaged account designed for individuals with high-deductible health plans to save for medical expenses.

Benefits

- Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

- Offers an opportunity for additional retirement savings if funds are not used for medical expenses.

Advanced Tax Saving Strategies

Utilizing Municipal Bonds

Tax Exemption (Tax saving investment options)

Municipal bonds, particularly those that are state and federal tax-exempt, are an excellent option for investors in higher tax brackets looking to receive tax-free income.

Investing in Real Estate Investment Trusts (REITs)

Tax Considerations

REITs offer a unique tax advantage in that they distribute most of their taxable income to shareholders, who then only pay taxes on those dividends.

Portfolio Diversification for Tax Optimization

The Role of Diversification (Tax saving investment options)

Diversifying your investment portfolio across various tax-advantaged accounts can significantly enhance your tax efficiency, reducing the overall tax impact on your investments.

Balancing Act

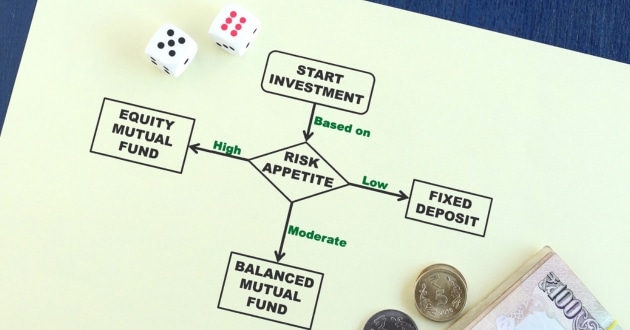

Investors should balance their portfolios across taxable, tax-deferred, and tax-free accounts to manage tax liabilities effectively based on their financial goals and tax situations.

Leveraging Life Insurance Policies for Tax Savings

Benefits of Whole Life Policies (Tax saving investment options)

Whole life insurance policies can serve as a tax-saving investment. The cash value accumulated in these policies grows on a tax-deferred basis, and if managed properly, policy loans can be taken out tax-free. This can be a strategic option for those looking to supplement retirement income without increasing their taxable income.

Investing in Qualified Small Business Stocks (QSBS)

Tax Exemption Features

Investing in qualified small business stocks offers significant tax advantages, including the potential exclusion of gains from taxes if certain conditions are met. This can include excluding up to 100% of gains from federal income taxes, making it an attractive option for those investing in small, domestic companies.

Retirement Annuities for Tax Deferral (Tax saving investment options)

Fixed and Variable Annuities

Retirement annuities, such as fixed or variable annuities, offer tax-deferred growth, similar to traditional retirement accounts. Investors can benefit from the compounding of earnings over time without the immediate tax liability, providing a steady income stream in retirement.

Deferred Capital Gains Strategies

Utilization of 1031 Exchanges

Real estate investors can benefit from 1031 exchanges, which allow the deferment of capital gains taxes on the exchange of similar kinds of properties. This strategy is particularly useful for real estate investors looking to grow their investments without the immediate tax burden.

Capitalizing on Agricultural and Timber Tax Breaks

Special Tax Considerations (Tax saving investment options)

Investing in agricultural or timber resources can offer unique tax benefits, including deductions and capital gains treatment on timber sales. These sectors provide opportunities not only for investment growth but also significant tax efficiency, appealing to those interested in more niche markets.

Each of these topics explores different facets of tax saving investment options, offering investors various ways to reduce tax liabilities while diversifying their investment strategies. By understanding and utilizing these options, investors can significantly enhance their financial efficiency and long-term growth potential.

Exploring Education Savings Accounts for Tax Benefits

Advantages of 529 Plans (Tax saving investment options)

Education Savings Accounts (ESAs) like the 529 Plan offer tax-advantaged benefits specifically for funding educational expenses. Contributions grow tax-free, and withdrawals for qualified education expenses, such as tuition and books, are also tax-exempt. This makes them a valuable option for parents planning for their children’s future education costs.

Maximize Returns with Dividend Reinvestment Plans (DRIPs)

How DRIPs Work (Tax saving investment options)

Dividend Reinvestment Plans allow investors to reinvest their stock dividends into additional shares automatically, often without brokerage fees. The reinvested dividends are still taxable, but the compounding effect over time can lead to substantial growth, effectively lowering the overall tax impact per share as the investment grows.

Enhance Your Financial Strategy with SmartAsset

Navigating your financial future requires precise planning and informed decisions, especially when it comes to investments and tax savings. SmartAsset is an invaluable resource that helps individuals optimize their financial strategies. Whether you’re looking into tax-saving investment options or need guidance on estate planning, retirement, or mortgages,

SmartAsset provides tools and detailed articles that make complex financial information accessible and actionable. With their range of calculators, from tax burdens to investment returns, SmartAsset equips you with the knowledge and tools needed to make smarter financial decisions.

Utilizing Roth IRA Conversions (Tax saving investment options)

Strategic Conversion Planning

Roth IRA conversions involve transferring funds from a Traditional IRA or 401(k) to a Roth IRA. This move can be strategically beneficial in years when income is lower, potentially reducing the tax rate on the converted amount. While this incurs taxes at the time of conversion, it allows for tax-free growth and withdrawals in retirement, offering significant tax savings in the long-term.

Investment Bonds with Tax Exemptions

Municipal Bonds (Tax saving investment options)

Municipal bonds are popular among tax-conscious investors because the interest income is often exempt from federal income taxes, and in some cases, state and local taxes as well. This feature makes them an attractive option for those in higher tax brackets looking to receive tax-free income.

Find Your Ideal Savings Plan with Blue Dollar Forge (Tax saving investment options)

When it comes to securing your financial future in Canada, choosing the right savings and investment plan is crucial. The best saving investment plans Canada at Blue Dollar Forge offers an extensive guide that breaks down the top options available. Whether you’re looking for high-interest savings accounts, tax-efficient investment vehicles like TFSAs and RRSPs, or flexible options like RESPs, this resource provides detailed comparisons to help you make informed decisions.

Each plan is evaluated based on factors such as potential returns, tax implications, and flexibility, making it easier for you to select the plan that best fits your financial goals. Dive into the guide to explore how you can grow your savings effectively and efficiently.

Conclusion in tax saving investment options

Tax saving investment options are essential tools for any savvy investor. By utilizing accounts like TFSAs, RRSPs, and HSAs, and incorporating strategies such as investing in municipal bonds and REITs, you can significantly enhance your financial growth while minimizing tax obligations. As always, consulting with a financial advisor or tax professional is recommended to tailor these strategies to your specific financial situation, ensuring compliance and optimization of your investment decisions.